what are back taxes owed

See your tax refund estimate. Here are four common options that could help you find some tax relief plus guidance on how to file back taxes and how many years you can file back taxes for.

Back Taxes Owed Orlando Fl Tax Accounting Firm Cpa

There are several steps you can take if you want to figure out how to pay taxes and not go into further financial arrears.

. If you cant pay the full amount due at the time of filing consider one of the payments. Ad BBB A Rating. The failure to pay penalty starts at 05 of your.

How To Pay Back Taxes. It may be necessary to contact the IRS to obtain tax records dating back a few years in order to find out what is owing. Filling out the tax forms for the years in which taxes werent paid can help predict how much in back taxes are owed.

However it does not eliminate back taxes owed to the Internal Revenue Service IRS. Fortunately the IRS is likely to accept a payment plan for smaller amounts of back taxes. Ad Prevent Tax Liens From Being Imposed On You.

Back taxes are any taxes that you owe that remain unpaid after the year that they are due. Determine how youll file your back taxes. Ad BBB A Rating.

Heres what to know about filing back taxes. Well calculate the difference on what you owe and what youve paid. Basically if you let an entire filing year go by without paying the IRS what you owe its.

If youve already paid more than what you will owe in taxes youll likely receive a refund. IRS tax debt is any amount of unpaid taxes owed to the government Back Taxes Owed To IRS after a tax return has been filed. As long as your taxes are overdue interest and penalties can add up fast.

Maximize Your Tax Refund. Its best for all taxpayers to file and pay their federal taxes on time. Solve All Your IRS Tax Problems.

The tax return can be filed late with a timely filed extension. This type of tax debt regularly accrues penalties and fines and. You May Qualify For This Special IRS Program.

Ad Honest Fast Help - A BBB Rated. Here are just a few of the issues that can arise if your business owes back taxes. Ad Our Tax Relief Experts Have Resolved Billions in Tax Debt.

According to the latest IRS data taxpayers owed more than 133 billion to the tax agency in the fall of 2021 at the end of a. Your first step is to file back tax returns if you owe back taxes. Apply For Tax Forgiveness and get help through the process.

The third possibility is an. Starting in 2002 it became legal for the IRS to garnish 15 of Disability benefits of those who are disabled and owe back taxes as well as Federal Old-Age and Survivor benefits. This little known plugin reveals the answer.

Interest and penalties accrue. - As Heard on CNN. But this payment option is limited to individual taxpayers who owe less than 50000 in back taxes and business filers who owe less than 25000.

2 days agoThe first checks and direct deposits from 3 billion in excess tax revenue will head back to Massachusetts taxpayers starting Tuesday when the calendar officially changes to. Whether you owe back taxes or current taxes you may be hit with significant penalties and interest accruals over time if you dont pay. Be prepared to pay fees or penalties.

Locate the IRS forms for the years you didnt file returns because tax laws and forms. Owe 10K In IRS Back Taxes. April 18 2019.

Based On Circumstances You May Already Qualify For Tax Relief. Solve All Your IRS Tax Problems. For filing help call 800-829-1040 or 800-829-4059 for TTYTDD.

A majority 55 owe more than 10000 in taxes with 28 owing between 10000 and. Back taxes are the money you owe to the Internal Revenue Service that was wholly or partially unpaid the year they were due. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

100 Money Back Guarantee. CPA Professional Review. Although the process is similar to filing an on-time tax return there are a few things to.

Heres a summary of some of the potential taxes that. - As Heard on CNN. Many Americans struggle to pay off back taxes.

How to File Back Taxes. Ad We Help Taxpayers Get Relief From IRS Back Taxes. If you owe back taxes you must file a past-due return with the IRS.

If you owe back taxes reach out to the IRS. If you need wage and income information to help prepare a past due return complete Form 4506-T Request for. When a small business declares bankruptcy it may reduce or eliminate debts owed to creditors.

What Is Tax Debt Unpaid Back Taxes Can Cost You Debt Com

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

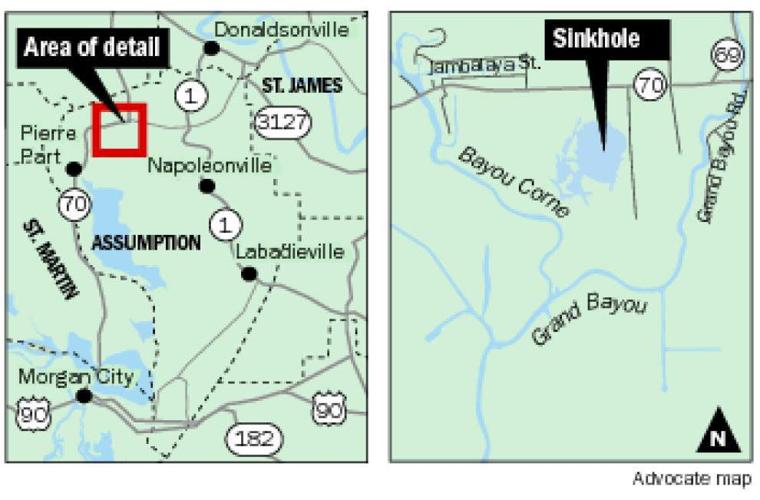

Assumption Parish Starting To Reap Millions In Back Taxes Owed Discovered After The Bayou Corne Sinkhole Communities Nola Com

If You Owe Back Taxes Try Making The I R S An Offer The New York Times

Back Taxes Owed Bf Borgers Cpa Pc

Owe Back Taxes Peter Petry Cpa

Updated 2020 Do You Owe Back Taxes Here S What To Do

Can Back Taxes Be Taken Out Of A Refund

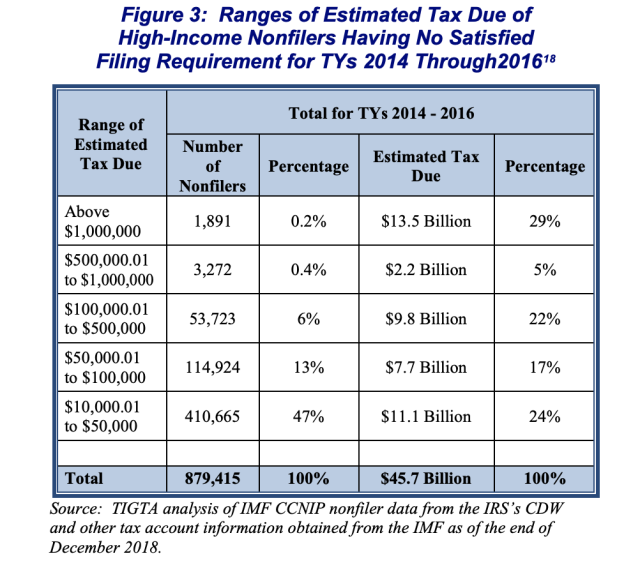

The Irs Is Failing To Collect Billions In Back Taxes Owed By Super Rich Americans

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

Back Taxes Owed Accounting Insurance Edofalltrades New York

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

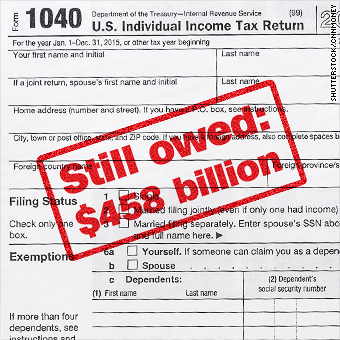

458 Billion In Taxes Go Unpaid Every Year

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Notice Of Levy For Back Taxes Owed By Jack Ruby 2 The Portal To Texas History

Best Tax Relief Options If I Owe 26 000 To 50 000 To The Irs

9 Takeaways On Businesses With Back Taxes Getting Federal Aid 9news Com